when are property taxes due in kane county illinois

The median property tax also known as real estate tax in Kane County is 511200 per year based on a median home value of 24500000 and a median effective property tax rate of 209 of property value. The median property tax on a 24500000 house is 257250 in the United States.

Deadline Approaching For Seniors To Apply For Property Tax Deferral Program Kane County Connects

Kane County Treasurer 719 S.

. A property must be the principal residence of the owner for the beginning of two consecutive years and the owner must be 65 or older by December 31 of the tax assessment year and meet certain household income requirements. The first installment will be due on or before June 1 2021 and the second installment will. Simply put the Illinois property tax system divides up each.

The break will not apply to payments done through a third. In most counties property taxes are paid in two installments usually June 1 and September 1. Payments made online can take up to 72 hours to receive in Treasurers office.

Because if your payment doesnt reach by the due date then your tax will become delinquent and you will be charged a. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

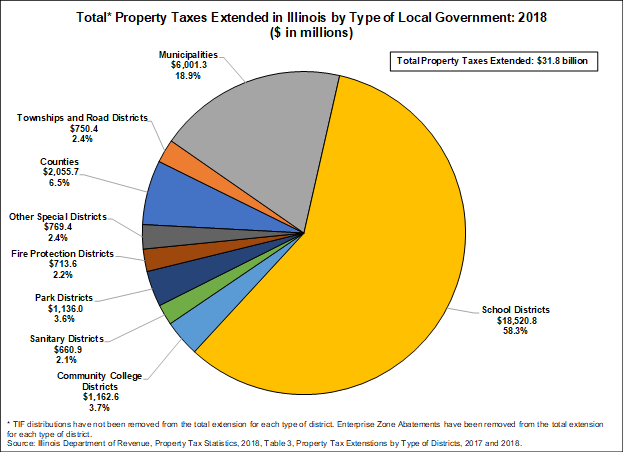

If Kane property taxes have been too costly for your budget resulting in delinquent property tax payments consider taking a quick property tax loan from lenders in Kane IL to save your property from a looming foreclosure. The taxes levied by each local government tax-ing district and the relative value of each taxable parcel in the boundaries of each taxing district. County boards may adopt an accelerated billing method by resolution or ordinance.

Aurora Office 5 E. Kane County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021.

The Kane County Board approved a plan to ensure no one pays late fees on payments due June 1 as long as they are turned in by July 1. 6302325990 CunninghamJohncokaneilus Website Kane County Circuit Clerk Theresa Barreiro Phone. Kilbourne announced today Thursday April 22 2021 that Kane County property tax bills will be mailed on April 30.

Mobile Home Search. 29 Deadline To Pay. The median property tax on a 24500000 house is 423850 in Illinois.

Kilbourne announced today Thursday April 22 2021 that Kane County property tax bills will be mailed on April 30. B Geneva IL 60134 FOIA Information. 630-232-5950 Para Español.

Property taxes are developed from two components. The first installment will be due on or before June 1 2021 and the second installment will be due on or before Sept. Bldg A Geneva IL 60134 Phone.

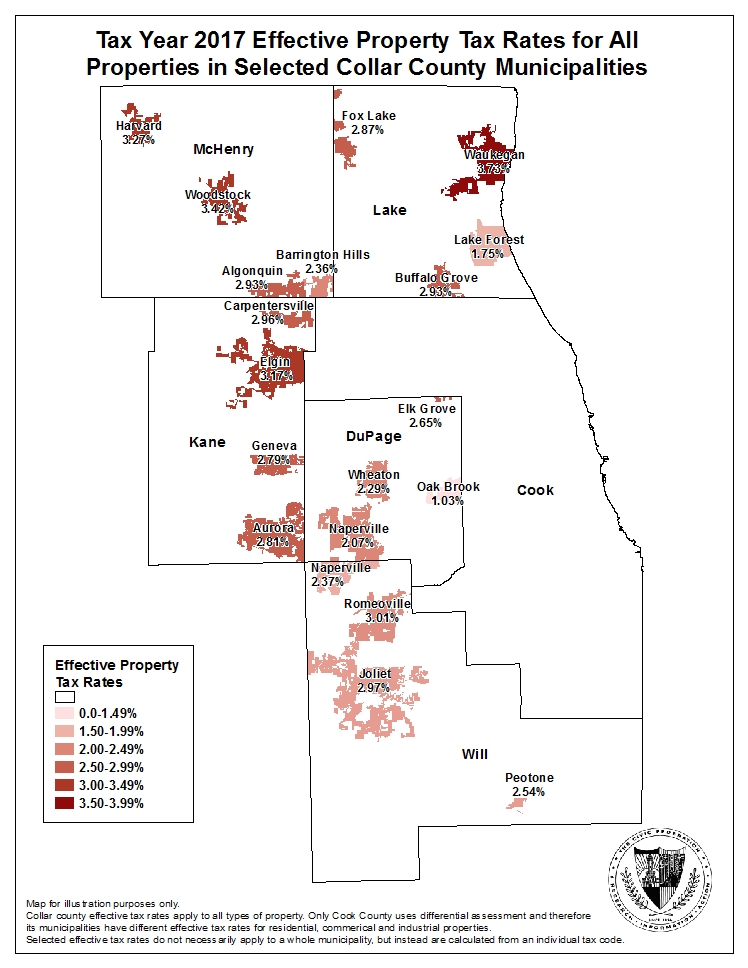

In Kane County tax rates generally range from below 8 to higher than 11 with a typical rate of about 95. The median property tax on a 24500000 house is 512050 in Kane County. Kane County collects on average 209 of a propertys assessed fair market value as property tax.

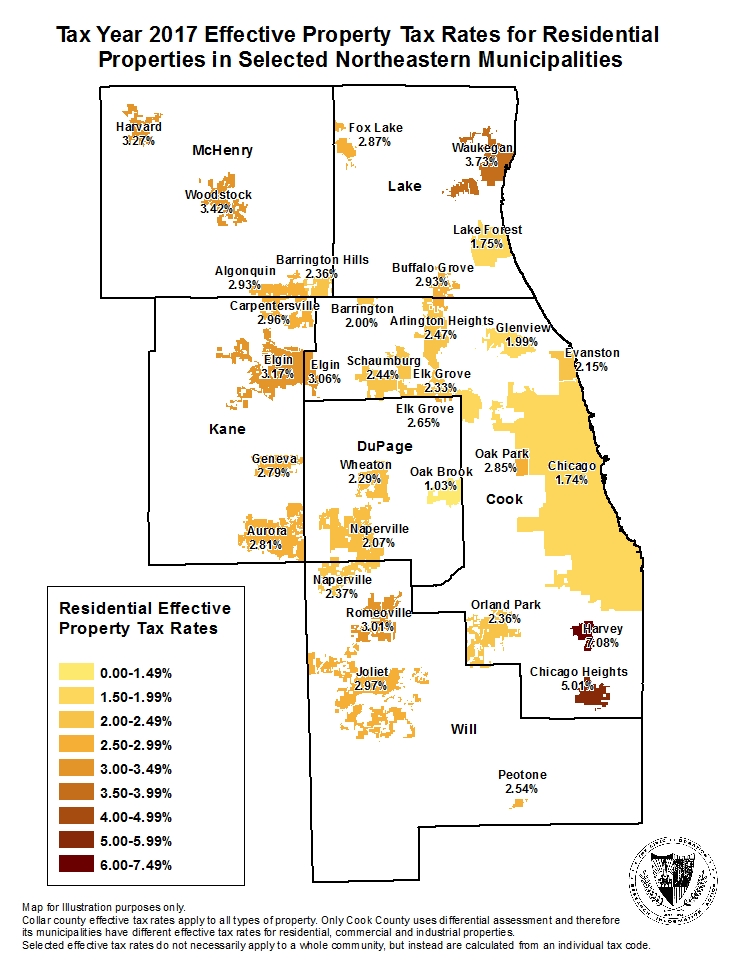

The median property tax also known as real estate tax in Kane County is 511200 per year based on a median home value of 24500000 and a median effective property tax rate of 209 of property value. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes. Kane County Treasurer Michael Kilbourne.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. If you have to go to court you better solicit for help from one of the best property tax attorneys in Kane County IL. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

Illinois Property Tax Rate and Levy Manual. The requested tax bill for tax year 2021 has not been prepared yet. Once taxes for the selected year have been extended the tax bill will be available.

So if you pay on the due date your payment must reach 1200 pm. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Kane County has one of the highest median property taxes in the United States and is ranked 32nd of the 3143 counties in order of median property taxes.

630-208-7549 Office Hours Monday Thru Friday. Communities Consumers Education Events Government Homeowners Kane County Kane County Treasurers Office Taxpayers. Cook County and some other counties use this.

Under Illinois law property taxes are the primary means of funding local governments. Property taxes are paid at the Kane County Treasurers office located at 719 S. Enter your search criteria into at least one of the following fields.

Kane County Government Center 719 S. What are the property taxes in Kane County Illinois. The Will County Board has not made any decisions on whether the property tax payment deadline of June 3 will be pushed back or if interest and fees will be waived.

6302323565 KilbourneMichaelcokaneilus Website Kane County Clerk John Cun ningham Phone. KANE COUNTY TREASURER Michael J. Tax Bill Is Not Ready.

6302323413 BarreiroTheresacokaneilus W ebsite. Then a hearing concerning any proposed tax hike has to be convened. On Unpaid Kane County Property Taxes Now Considered Delinquent Jan.

If you disagree with the countys conclusion you can appeal to a state board or panel. Kanecountyconnects January 20 2021 Comments Off. Kane County Treasurer Michael J.

Protesting your propertys tax value is your right. Kane County Property Tax Inquiry. Batavia Avenue Geneva ILYou may call them at 630-232-3565 or visit their website at.

Annexations Disconnections Dissolutions and Organization of Taxing Districts New Subdivision Plats. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. Downer Pl Suite F Aurora IL 60505.

They can be even higher if a property is in a special- service area.

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Real Estate News

How To Appeal Property Taxes In Geneva Il Beautiful Places Valley View Forest Preserve

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Reopen Illinois Covid 19 Real Estate Updates Illinois Realtors

Cook County Il Property Tax Search And Records Propertyshark

An Inventory Of Local Governments In Illinois Counties The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Transfer Taxes What Are They How Much Are They Who Pays Mortgage Blogs Federal Student Loans Private Student Loan

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

How To Pay Your Property Tax Bill In Kane County Il Kane County Connects

Important Reminder Property Tax 2nd Installment Is Due Sept 1 Kane County Connects

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Tax Lien Registry Tax Lien Registry

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Illinois Budget Includes 1 Billion In One Time Relief For Grocery Gas Some Property Taxes Kane County Connects

Cash Rents Rise In 2021 With Implications For 2022 Farmdoc Daily

Homes For Rent In Kane And Mchenry County In 2022 Renting A House Real Estate News Algonquin